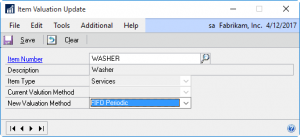

Item Valuation Update sets the Valuation Method of non-Sales Inventory type items so they can be used on the GP Bill of Materials for a Standard Cost item.

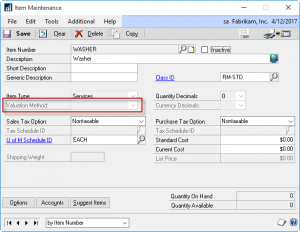

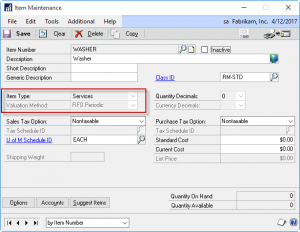

For example, some items may be have so little value that you do not want to track inventory, but they do need to be recorded on the BOM. As shown above, and item for WASHERS is set up as the “Services” type item so that GP does not track inventory quantities of Washers, but using the Item Type of Services causes the window to blank-out the Valuation Method. All three non-inventory Item Types (Misc Charges, Services and Flat Fees) all behave the same way.

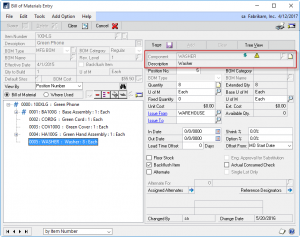

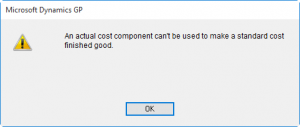

When you attempt to add WASHER to the BOM for 100XLG (a Standard Cost item), GP presents the warning message shown above. It will only allow Standard Cost components on the BOM of a Standard Cost parent.

Item Valuation Update is used to set the Valuation Method of WASHERS to FIFO Periodic (Standard Cost), which allows the WASHERS item to now be added to the BOM.